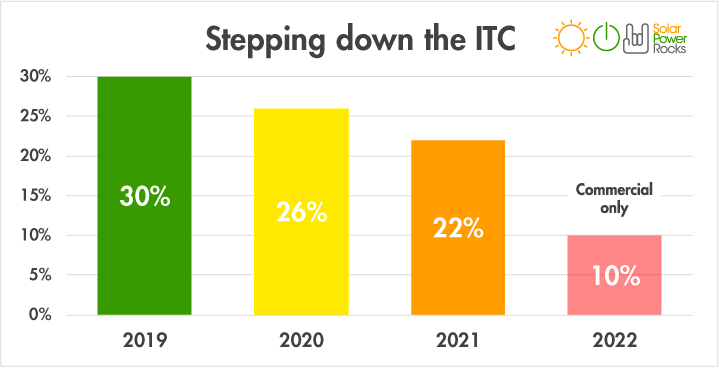

The federal solar tax credit also known as the solar investment tax credit or itc is the single most important solar incentive available in the united states.

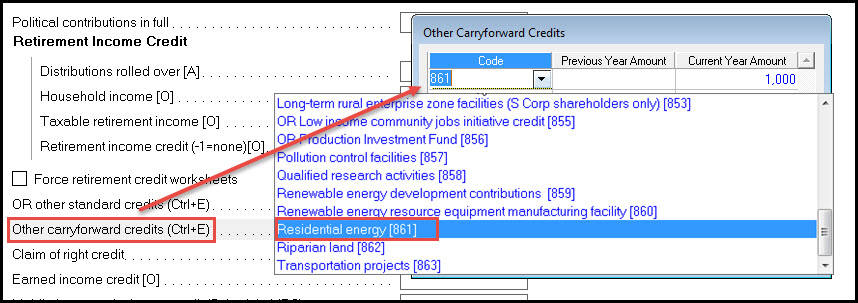

Solar energy credit carryforward.

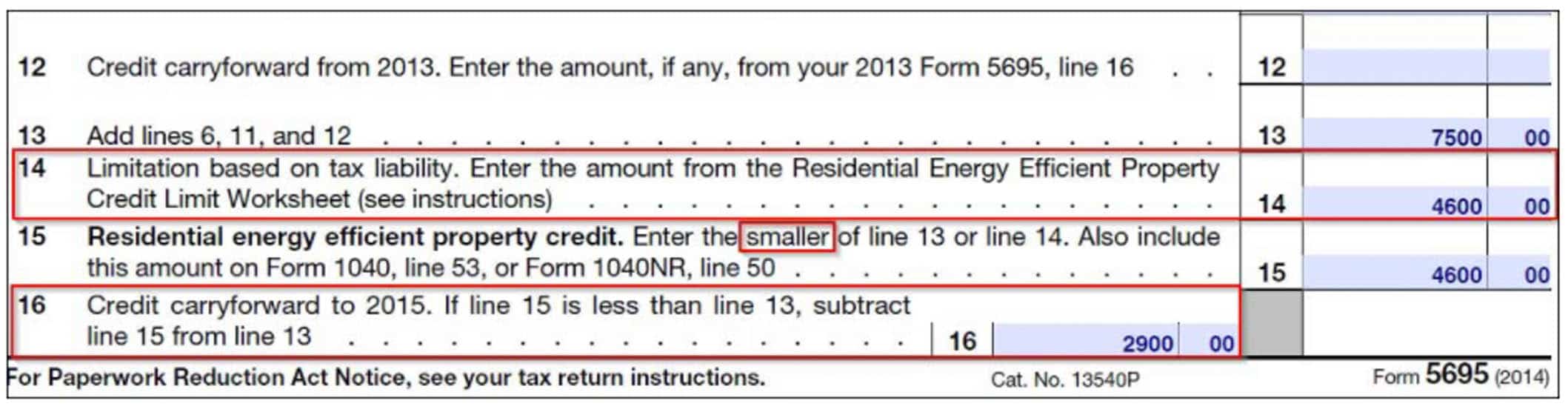

If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs.

Add your renewable energy credit information to your typical form 1040.

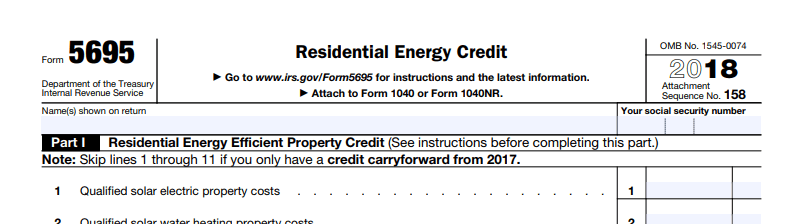

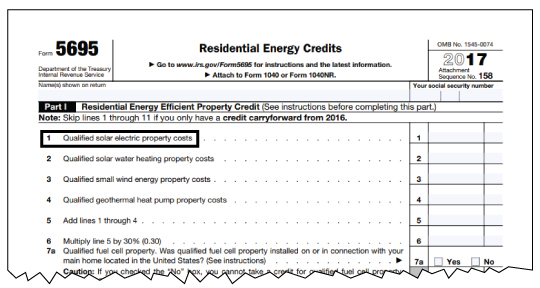

Complete irs form 5695 to add up your renewable energy credits click the link for a step by step walkthrough on filing your tax forms.

The residential energy credits are.

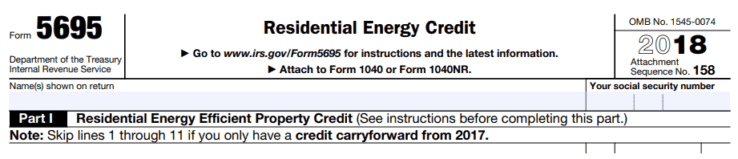

To claim the credit you must file irs form 5695 as part of your tax return.

The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing an average sized residential solar.

However it is not yet clear whether you can carry unused credits to years after the solar credit expires.

Yes the unused credit will carry forward to future years if you tax liability limits the amount this year.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

You calculate the credit on the form and then enter the result on your 1040.

We hope this serves as a good introduction to the federal solar tax credit and helps you navigate the research process.